Tech tumbles and the euro sinks to long-term support

April 27,2022 06:35:56Overnight Headlines

*Australian surging inflation builds case for election rate hike

*Russian gas supply to Poland resumes, Ukraine condemns “gas blackmail”

*Dollar hits its highest level since March 2020, best month since January 2015

*Oil prices paralysed between Russia sanctions and China lockdowns

US equities fell sharply with the Nasdaq tumbling 3.95%. It made a multi-week low, closing at 13,009. The tech-heavy index is now in bear market territory for the year, off more than 20% from its highs. The S&P500 dropped 2.8% and the Dow sold off 2.4%. Tech and consumer discretionary were the biggest losers, with earnings not helping. Asian markets are better bid this morning with Chinese stocks in the green. Futures are slightly lower in Europe, but positive in the US.

USD rose by as much as 0.8%, smashing through 102 on the DXY. The euro broke down through 1.07 and is eyeing the March 2020 low at 1.0635. GBP continued its march lower crashing through 1.26. Sterling is down over 4% in five days. JPY continues to consolidate off multi-year lows after a dip in Japan’s unemployment rate. AUD and NZD have found a bid on a further rebound of the yuan and better than expected Aussie CPI data.

Event Takeaway – Tech capitulation

Broad selling hit equity markets yesterday with tech particularly suffering. The Nasdaq Composite hit its lowest level in more than a year, with the biggest single-day decline since September 2020. The FANG+ index is in a bear market, just in April. And that’s even though it’s an equally weighted index that includes Twitter.

The move came ahead of Alphabet and Microsoft earnings after the closing bell. These were mixed with the former falling in after hours after Google’s parent company missed earnings. Slowing momentum in online advertising saw disappointing YouTube results.

Highly valued companies suffer during bouts of negative sentiment, currently caused by inflation and impending interest rate rises. The global threat of coronavirus lockdowns in China is also weighing. We get Meta’s earnings after the close tonight with Apple and Amazon on Thursday.

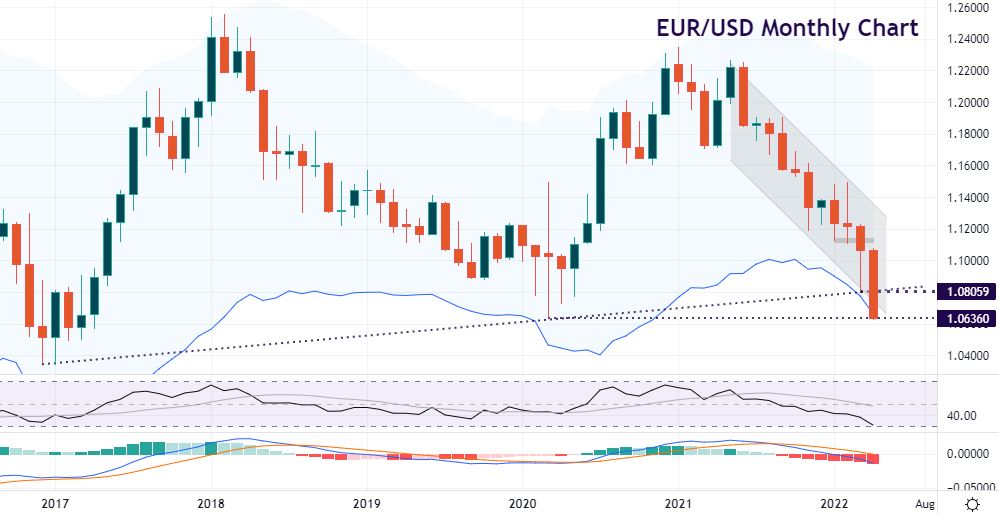

Chart of the Day – EUR/USD sits on long-term support

King dollar is certainly reigning supreme this month. The world’s reserve currency has appreciated over 4% in April. Bets on ever-tighter Fed policy have grown as inflationary pressures have persisted. As we have written before, front-loading of rate hikes, and getting to the neutral rate as fast as possible appears to be the Fed way. The terminal rate is now near 2.77% by the end of 2022. This is up from expectations of 0.8% at the start of the year, which includes three 50bps hikes in the coming months.

Few currencies can compete with this interest rate differential. While the euro is faring better than most other majors, markets now price around 75bps of ECB rate rises by year end, down from 95bps on Friday. We get eurozone CPI releases starting tomorrow which may add some fuel to rate rise hopes. We are not massively oversold so the 250bp EUR/USD drop can continue. The March 2020 bottom is at 1.0635. The figure is next support ahead of a key floor at 1.05. Resistance is roughly around 1.07 and then 1.0739.

Disclaimer

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Pembukaan akun cepat & mudah

-

Daftar

Pilih tipe akun dan kirimkan aplikasi Anda

-

Danai

Danai akun Anda menggunakan metode pendanaan yang bervariasi

-

Trade

Akses 400+ instrumen CFD di semua kelas aset melalui MT4/MT5

Hanya itu. Sangat mudah untuk membuka akun trading Forex dan CFD.

Selamat datang ke dunia trading!

BUKA AKUN LIVE